Retirement planning is crucial for financial stability in old age. The Unified Pension Scheme is a government initiative designed to provide a standardized pension system for workers across sectors. It consolidates different pension schemes to ensure uniformity and ease of access.

What is the Unified Pension Scheme?

The Unified Pension Scheme is an initiative by the Government of India to bring various pension schemes under a single umbrella. It aims to simplify retirement benefits and provide financial security to employees across government and private sectors.

Key Features of the Unified Pension Scheme

| Feature | Details |

|---|---|

| Coverage | Central & state government employees, private sector workers, unorganized sector |

| Fund Management | Managed by PFRDA (Pension Fund Regulatory and Development Authority) |

| Contributions | Fixed percentage of salary contributed by both employer & employee |

| Tax Benefits | Tax exemptions on contributions under Section 80CCD |

| Portability | Pension can be transferred across jobs and sectors |

| Minimum Pension Guarantee | Ensures minimum pension amount post-retirement |

Eligibility Criteria for Unified Pension Scheme

To avail benefits under the Unified Pension Scheme, individuals must meet certain eligibility requirements:

- Age Limit:

- Minimum age: 18 years

- Maximum age: 60 years

- Employment Type:

- Central & state government employees

- Private sector employees

- Self-employed individuals (under specific provisions)

- Contribution Requirement:

- Employees and employers contribute a fixed percentage of the salary towards the pension fund.

- Minimum Service Period:

- A minimum of 10 years of contribution is required to be eligible for pension benefits.

Unified Pension Scheme vs. National Pension System (NPS)

Many individuals confuse the Unified Pension Scheme with the National Pension System (NPS). Here’s a comparison:

| Feature | Unified Pension Scheme | National Pension System (NPS) |

|---|---|---|

| Scope | Covers multiple pension schemes under one framework | A voluntary contribution-based scheme |

| Employer Contribution | Mandatory for organized sector | Optional |

| Tax Benefits | Available under Section 80CCD | Available under Section 80C & 80CCD |

| Minimum Pension Guarantee | Yes | No |

| Portability | Fully portable across jobs | Limited portability |

Unified Pension Scheme Calculator

Many individuals want to estimate their pension under this scheme. A Unified Pension Scheme Calculator helps in determining the approximate pension amount based on the following factors:

- Age at Retirement

- Monthly Salary

- Employee Contribution (e.g., 10% of basic salary)

- Employer Contribution (matching employee contribution)

- Investment Returns (based on PFRDA fund performance)

- Inflation Rate Adjustment

Example Calculation

Let’s assume:

- Monthly Salary: ₹50,000

- Employee Contribution: 10% (₹5,000)

- Employer Contribution: 10% (₹5,000)

- Expected Annual Return: 8%

- Investment Duration: 30 years

Using these inputs, an individual can use an online Unified Pension Scheme Calculator to estimate their corpus at retirement and the expected monthly pension.

Unified Pension Scheme Gazette Notification

The government periodically releases official Unified Pension Scheme Gazette Notifications to update policies, rules, and benefits. These notifications can be accessed via:

- Official Gazette of India (www.egazette.nic.in)

- Pension Fund Regulatory and Development Authority (PFRDA) website

- Ministry of Finance portal

Key Points from Recent Gazette Notifications

- Standardization of Benefits: Uniform pension benefits for all employees

- Mandatory Enrollment: Certain sectors required to enroll in the scheme

- Increased Pension Contribution: Employers required to match employee contributions

To stay updated, individuals can download Unified Pension Scheme PDF versions of the notifications for reference.

Unified Pension Scheme Latest News & Updates

Keeping track of the Unified Pension Scheme Latest News is crucial for employees and pensioners. Here are some recent updates:

Recent Developments (2025)

📌 Government Revises Pension Contribution Limits

- The government is considering increasing the employer contribution from 10% to 12% to enhance pension benefits.

📌 Online Pension Account Access

- A new digital pension portal is being introduced to allow users to track contributions, calculate pensions, and withdraw funds seamlessly.

📌 Unified Pension Scheme UPSC Relevance

- The scheme is an important topic in UPSC Economy & Social Issues syllabus, especially in GS Paper 3 (Economic Development) and GS Paper 2 (Governance & Welfare Schemes).

Benefits of the Unified Pension Scheme

For Employees

- Guaranteed Retirement Income

- Tax Benefits on contributions

- Portability across jobs and sectors

For Employers

- Structured Retirement Plan for employees

- Tax Deductions on employer contributions

For the Government

- Financial Security for Citizens

- Encourages Long-Term Savings

Challenges & Criticism

While the Unified Pension Scheme has many advantages, some concerns remain:

- Lack of Awareness – Many employees are unaware of its benefits.

- Investment Risks – Returns depend on market performance.

- Delayed Withdrawals – Pension withdrawals can be bureaucratic.

To address these issues, the government is working on simplified withdrawal processes and digital pension tracking systems.

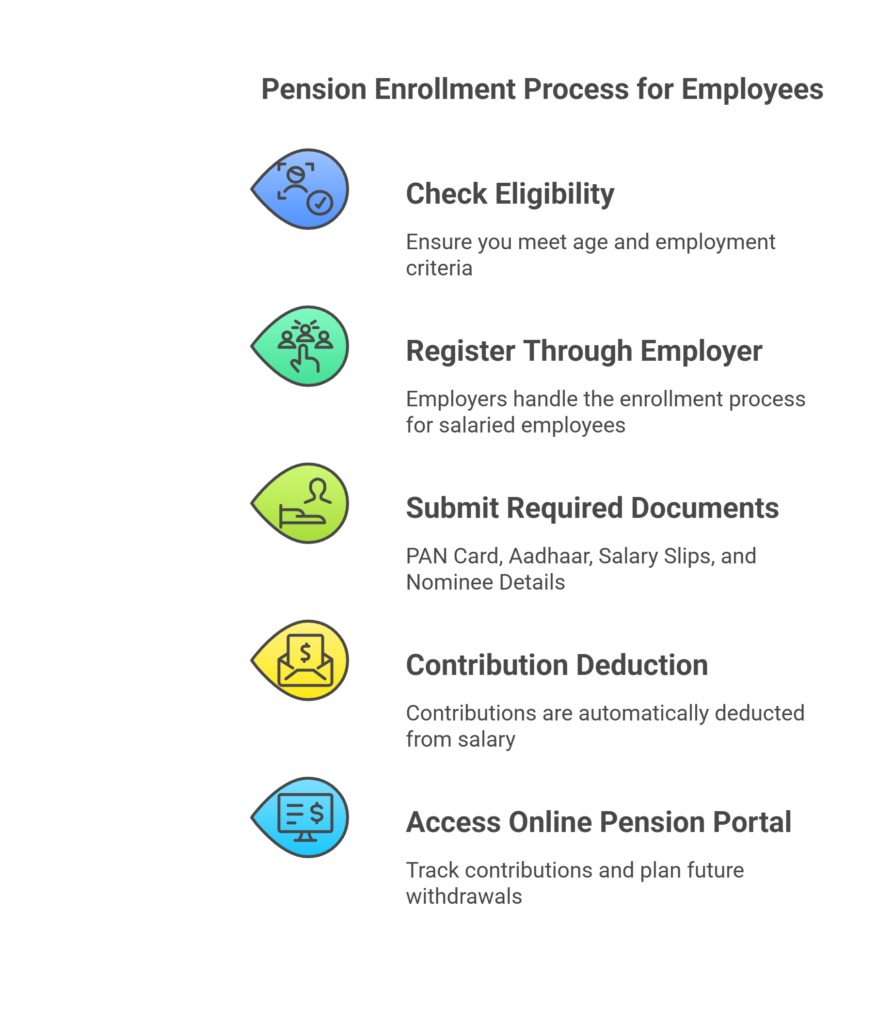

How to Enroll in the Unified Pension Scheme?

Steps for Government & Private Sector Employees

10 Genius Ways to Save Money & Build Wealth Like the 1%

Investment Strategies for Maximizing Pension Benefits

A well-planned investment approach can significantly boost the pension corpus. Here’s how employees can maximize returns under the Unified Pension Scheme:

1. Choosing the Right Pension Fund

- The Pension Fund Regulatory and Development Authority (PFRDA) offers multiple pension fund options.

- Employees can choose between low-risk, moderate-risk, and high-risk funds based on their risk appetite.

| Fund Type | Risk Level | Expected Returns (per year) |

|---|---|---|

| Government Bonds | Low | 6-7% |

| Balanced Fund | Medium | 8-9% |

| Equity-Linked Fund | High | 10-12% |

Best Strategy: Younger employees can opt for equity-heavy funds for higher returns, while older employees can shift to low-risk bond funds.

2. Increasing Contribution for Higher Retirement Corpus

- The minimum contribution is 10% of basic salary, but employees can increase their contribution to 12-15% for better retirement security.

- Higher contributions result in exponential corpus growth due to compounding.

💡 Example:

- ₹5,000/month contribution for 30 years at 8% annual return → ₹75 lakh corpus

- ₹8,000/month contribution for 30 years at 8% annual return → ₹1.2 crore corpus

Tip: Using the Unified Pension Scheme Calculator, employees can plan their monthly contributions effectively.

Withdrawal & Pension Disbursement Process

Types of Withdrawals

1. Regular Pension Withdrawal (Post-Retirement)

- Employees can withdraw 60% of the corpus as a lump sum

- The remaining 40% is used to buy an annuity for monthly pension payments

2. Early Withdrawal (Before Retirement)

- Employees can withdraw only 20-25% of the corpus before 60 years

- The rest remains invested until retirement

3. Pension Transfer (In Case of Job Change)

- Pension contributions can be seamlessly transferred between organizations

📢 New Update: The government is working on a fully digital withdrawal process to reduce paperwork and delays.

Expert Opinions on the Unified Pension Scheme

📌 Dr. Rajiv Kumar, Economist

“The Unified Pension Scheme is a revolutionary step in India’s financial security framework. By ensuring portability, digital access, and minimum pension guarantees, it encourages long-term savings and financial independence for retirees.”

📌 Nilesh Shah, Fund Manager

“Investors should utilize equity exposure in their pension funds to maximize wealth accumulation. Young employees can leverage compounding benefits by choosing higher-risk pension portfolios.”

📌 Arundhati Bhattacharya, Former SBI Chairperson

“The biggest challenge is awareness. More financial literacy programs are needed to educate employees on the benefits of structured pension savings.”

Upcoming Developments in the Unified Pension Scheme (2025 & Beyond)

1. Introduction of AI-Based Pension Management

- AI-driven pension platforms to track investments, suggest fund allocation, and automate retirement planning.

2. Increased Government Contributions for Low-Income Groups

- The government is considering raising employer contributions for employees earning below ₹25,000/month.

3. Digital Pension Accounts with Instant Access

- Pensioners can instantly access their funds, track pension status, and request withdrawals online via a dedicated mobile app.

4. Higher Pension Payouts for Women & Senior Citizens

- Special provisions are being planned to provide extra benefits to women retirees and senior citizens above 75 years.

Analysis:

The Unified Pension Scheme is a game-changer for India’s retirement planning. By standardizing pension benefits, increasing security for employees, and ensuring a seamless process, it helps build a financially stable future for millions.

For the latest updates, individuals should regularly check government websites and financial news portals.

📢 Stay informed!

What is the retirement age under the Unified Pension Scheme?

The retirement age is typically 60 years, but early withdrawals have certain conditions.

Can private sector employees enroll in the Unified Pension Scheme?

Yes, the scheme covers both government and private sector employees.

Where can I download the official Unified Pension Scheme PDF?

PDFs are available on the Ministry of Finance and PFRDA websites.

Is the Unified Pension Scheme UPSC relevant?

Yes, it is important for UPSC aspirants under economic and welfare policies.

What happens if I switch jobs?

Your pension contributions remain intact and get transferred automatically.

Can I withdraw my pension before retirement?

Partial withdrawal is allowed under special conditions (medical emergency, education, etc.)

Is this scheme mandatory?

It is mandatory for government employees and voluntary for private sector employees & self-employed individuals.

Reach Out: