An emergency fund is your financial safety net, protecting you from unexpected expenses like medical emergencies, job loss, or urgent car repairs. Without one, you might rely on high-interest loans or credit cards, which can lead to financial distress.

What is an Emergency Fund?

An emergency fund is a stash of money set aside to cover unforeseen expenses. It ensures you don’t have to rely on loans, credit cards, or borrow money during financial hardships.

Purpose: Covers emergencies like medical expenses, home repairs, or job loss

Accessibility: Kept in a liquid, easily accessible account

Amount Needed: Varies depending on income, expenses, and risk factors

Why is an Emergency Fund Important?

1. Protects Against Job Loss

Losing a job can be financially devastating. Having cash for emergencies helps cover rent, groceries, and bills until you find a new income source.

2. Avoids High-Interest Debt

Without an emergency relief fund, you might rely on credit cards or personal loans, leading to debt traps.

3. Covers Unexpected Medical Bills

Medical emergencies can happen anytime. An emergency fund ensures you get the treatment you need without financial stress.

4. Provides Peace of Mind

Knowing you have money set aside for emergencies reduces stress and helps you focus on long-term financial goals.

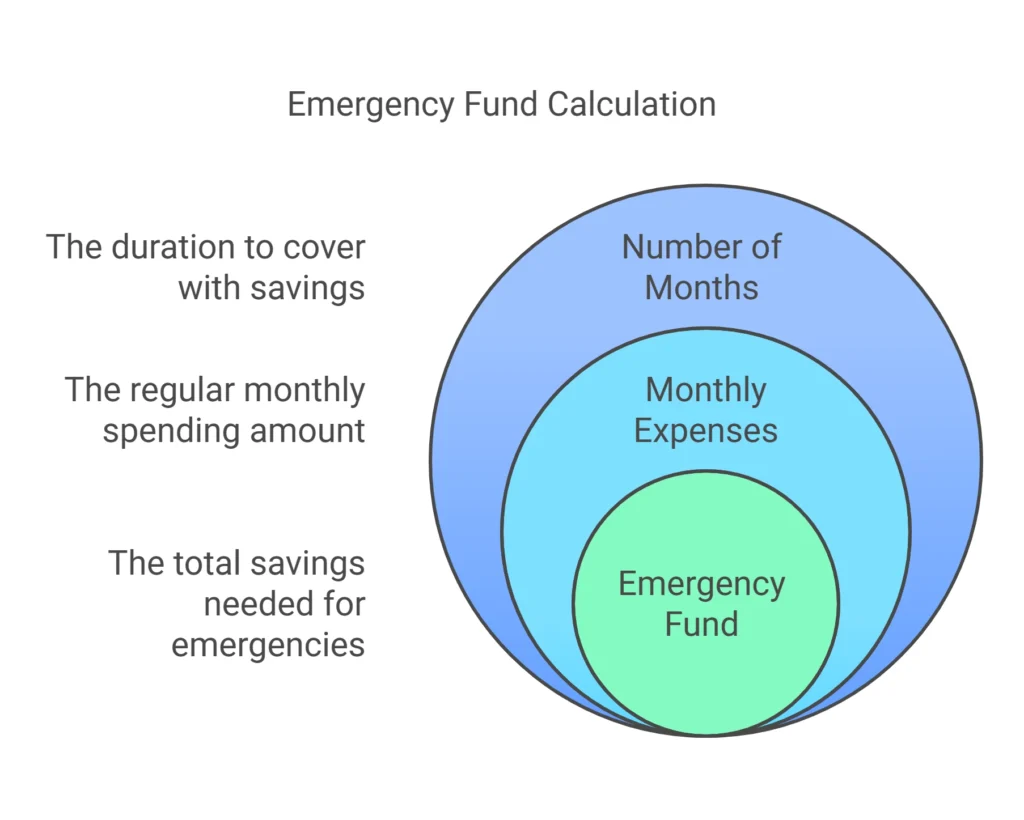

How to Calculate Your Emergency Fund?

The ideal amount depends on your expenses, income stability, and risk factors.

Step 1: Identify Monthly Expenses

List all essential monthly expenses, including:

| Expense Category | Amount (₹ / $ / €) |

|---|---|

| Rent / Mortgage | $1200 |

| Utilities (Electricity, Water, Internet) | $200 |

| Groceries | $400 |

| Transportation | $250 |

| Insurance | $150 |

| Miscellaneous | $100 |

| Total Monthly Expenses | $2,300 |

Step 2: Decide the Fund Duration

Experts recommend saving 3 to 6 months’ worth of expenses.

Stable Income? → 3 months’ expenses

Unstable Income? → 6–12 months’ expenses

🔹 Example Calculation:

- Monthly expenses = $2,300

- 3 months’ emergency fund = $6,900

- 6 months’ emergency fund = $13,800

Emergency Fund Calculator

Use this simple formula to determine how much you need:

Emergency Fund = Monthly Expenses × Number of Months

🔹 Example Scenarios:

| Income Stability | Monthly Expenses | Fund Duration | Total Fund Needed |

|---|---|---|---|

| Stable Job | $2300 | 3 Months | $6,900 |

| Freelance Income | $2300 | 6 Months | $13,800 |

| High Risk (Business Owner) | $2300 | 12 Months | $27,600 |

Where to Keep Your Emergency Fund?

Your emergency fund should be safe and accessible. Best options include:

- Easily accessible

- Earns interest

2. Fixed Deposits (FDs) with Easy Withdrawal

- Safer than regular savings

- Offers better returns

3. Liquid Mutual Funds - Offers better returns than savings accounts

- Suitable for those willing to take minor risks

Avoid: - Stocks – Too volatile

- Real Estate – Not liquid

- Cryptocurrencies – Highly unpredictable

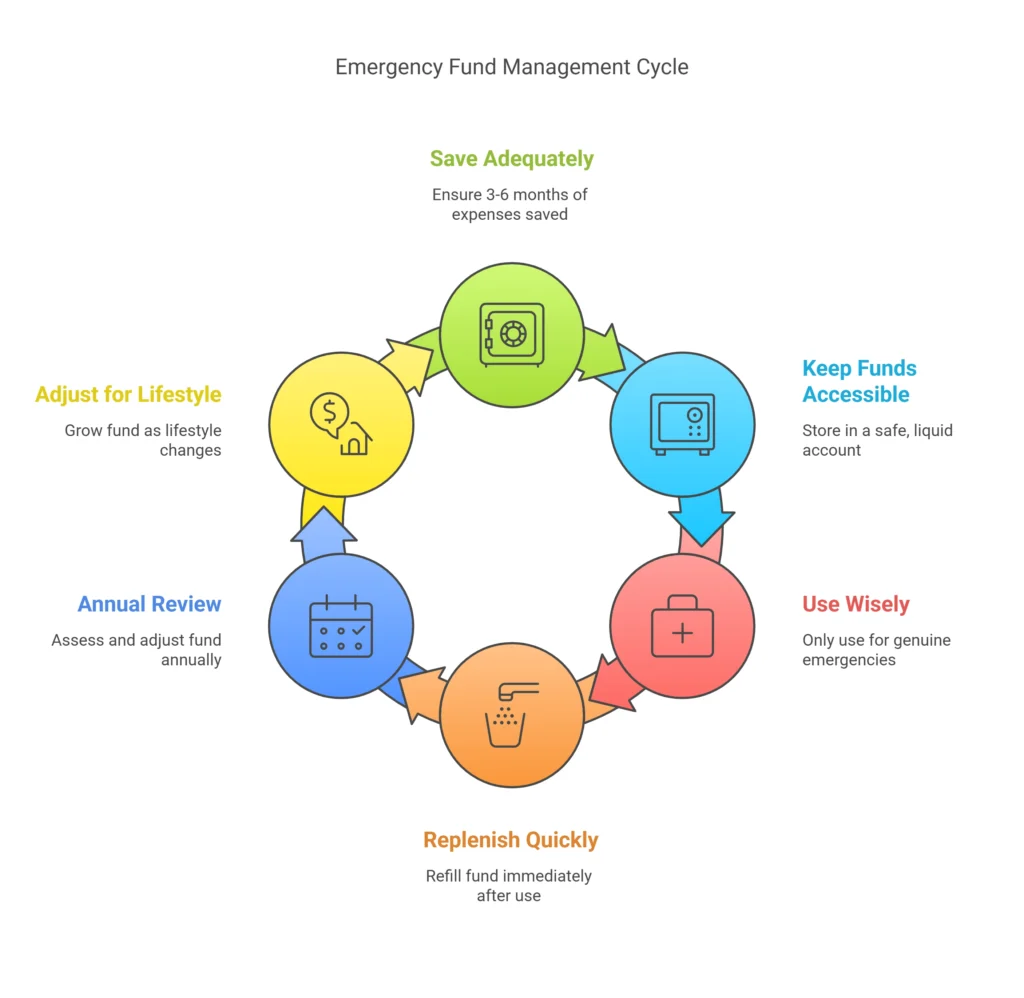

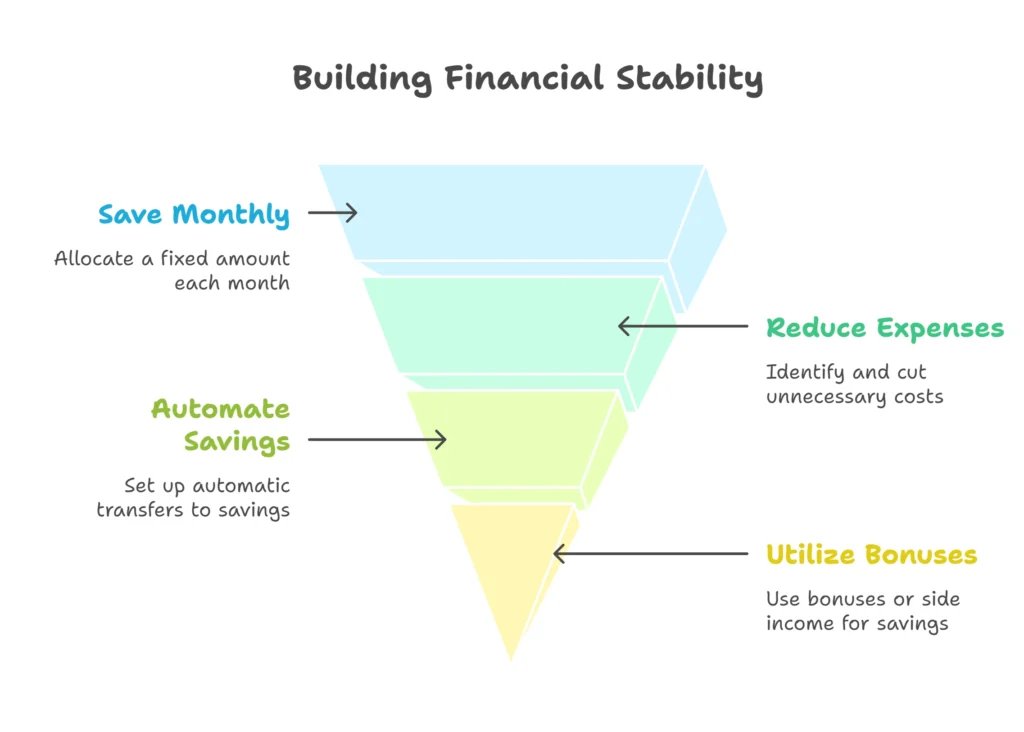

How to Build an Emergency Fund?

Building an emergency fund requires discipline and planning.

1. Set a Monthly Savings Target

Allocate a fixed percentage of your income to the emergency fund.

🔹 Example: Save $200 per month → $2,400 in a year

2. Automate Your Savings

Set up an automatic transfer to a separate savings account to stay consistent.

3. Cut Unnecessary Expenses

Review your spending and reduce non-essential costs to save faster.

| Unnecessary Expense | Monthly Savings ($) | Yearly Savings ($) |

|---|---|---|

| Eating Out | $100 | $1,200 |

| Streaming Subscriptions | $20 | $240 |

| Online Shopping | $60 | $720 |

| Total Savings | $180 | $2,160 |

Pro Tip: Redirect these savings into your emergency fund and build financial security faster!

When to Use Your Emergency Fund?

Only use it for genuine emergencies, such as:

- Job loss

- ️ Medical emergencies

- ️ Urgent home repairs

- ️ Unexpected travel due to a crisis

Avoid using it for: - Vacation trips

- Shopping splurges

- Luxury purchases

If you use it, replenish it as soon as possible.

How an Emergency Fund Can Save You Money

Having an emergency fund not only prevents financial stress but also helps you save money in the long run. Here’s how:

| Without Emergency Fund | With Emergency Fund |

|---|---|

| Pay high-interest debt (credit cards, loans) | Avoids borrowing money |

| Emergency medical bills → Loans | Pays bills stress-free |

| Sudden job loss → No savings → Financial crisis | Covers expenses until a new job is found |

| Car breakdown → Borrow money | Pays repair costs immediately |

Bottom Line: A strong emergency fund saves you from unnecessary debt and provides financial peace of mind.

How to Replenish Your Emergency Fund After Using It?

Used your emergency fund? Follow these steps to rebuild it fast:

Step 1: Cut Back on Non-Essentials

Reduce eating out, online shopping, and subscriptions.

Step 2: Increase Savings Rate

Step 3: Use Unexpected Money

🔹 Bonuses

🔹 Tax refunds

🔹 Side hustle income

Step 4: Automate Deposits Again

Set up auto-transfer to keep your emergency fund growing.

🔹 Goal: Refill your fund within 6–12 months.

Common Myths About Emergency Funds

“I Don’t Need an Emergency Fund, I Have a Credit Card”

🔹 Credit cards charge high interest, while an emergency fund is interest-free.

“I Can Invest Instead of Saving for Emergencies”

🔹 Investments fluctuate. You may lose money when you need it the most.

“I’ll Start Saving When I Earn More”

🔹 Emergencies can happen anytime. Start saving even with a small amount.

Common Mistakes People Make with Emergency Funds

Mistake #1: Not Having One at All

Many people think, “I have a steady job, I don’t need an emergency fund.”

But job security is never guaranteed. Always be prepared!

Mistake #2: Keeping It in a Fixed Deposit Without Liquidity

FDs with long lock-in periods make it hard to access money during emergencies.

Instead, use a savings account or liquid mutual funds for quick access.

Mistake #3: Using It for Non-Emergencies

- Buying the latest iPhone

- Booking an expensive vacation

- Shopping for luxury items

Solution: Set strict rules for when you can use your emergency fund.

Start Your Emergency Fund Today!

🔹 Open a separate savings account

🔹 Set a monthly savings goal

🔹 Use an emergency fund calculator to determine the amount

🔹 Stay disciplined—don’t touch it unless necessary!

A strong emergency fund = A secure financial future!

💬 What’s Your Emergency Fund Goal?

Share in the comments below! Let’s build financial security together.

Subscribe to our newsletter!

Reach Out:

Reach Out At:

What is an Emergency Fund?

A financial cushion for unexpected expenses

Helps avoid debt and financial stress

Should cover 3–6 months of expenses

How to Calculate Your Emergency Fund?

Monthly expenses × Number of months

Example: $2,900/month × 6 months = $17,400

How much emergency fund should I have?

Financial experts recommend 3 to 6 months’ worth of expenses. If you have an unstable income (freelancer, business owner), aim for 6–12 months.

How can I build my emergency fund quickly?

1. Automate monthly savings

2. Reduce unnecessary expenses

3. Allocate bonuses, tax refunds, or side hustle income

4. Sell unused items for extra cash

Should I invest my emergency fund?

No! Your emergency fund must be safe, liquid, and easily accessible. Avoid investing in stocks, crypto, or real estate.

Can I use my emergency fund for planned expenses?

No. Planned expenses (like vacations, weddings, or home upgrades) should be budgeted separately. Your emergency fund is only for unexpected financial shocks.

Where should I keep my emergency fund?

Best options:

️1. High-yield savings accounts (easy access + interest)

2️. Fixed deposits (FDs) with withdrawal flexibility

3️. Liquid mutual funds (moderate returns, easy withdrawals)

which of the following expenses would be a good reason to spend money from an emergency fund?

1. Job Loss or Income Reduction

2. Medical Emergencies

3. Major Car Repairs

4. Essential Home Repairs

5. Family Emergencies

6. Sudden Legal Expenses

Three Questions to Ask Before Using Your Emergency Fund

Is this a real emergency or just an inconvenience?

Do I have any other options to cover this cost?

Will this expense impact my ability to meet essential needs?

in what way is your emergency fund a form of insurance?

An emergency fund acts like self-insurance because it protects you from financial hardship due to unexpected events. While it’s not a traditional insurance policy, it serves a similar purpose:

1. Risk Protection – Just like insurance protects against loss (health, auto, home), an emergency fund shields you from financial setbacks like job loss or medical emergencies.

2. Immediate Coverage – Unlike insurance claims, which may take time to process, an emergency fund provides instant access to cash when needed.

3. Avoids High-Cost Borrowing – Without an emergency fund, people often rely on credit cards or loans, leading to high-interest debt. Your fund eliminates this risk.

4. Customizable & Flexible – Unlike insurance policies that cover specific risks, your emergency fund can be used for any unforeseen expense, from home repairs to medical bills.

How long does it take to build an emergency fund?

It depends on your savings rate. If you save $200 per month, a $6,000 emergency fund (3 months’ expenses) would take 2.5 years. However, you can build it faster by:

1. Increasing your savings rate

2. Using bonuses, tax refunds, or side hustle income

3. Cutting unnecessary expenses

Should I have more than one emergency fund?

It’s a good idea! Some people keep:

Short-term emergency fund (1 month’s expenses) in a high-yield savings account for quick access.

Long-term emergency fund (3–6 months’ expenses) in a liquid investment like a money market fund or fixed deposit for better returns.

Pro Tip: Multiple funds help you stay prepared for both small & big emergencies!