India Union Budget 2025 vs 2024: Key Differences, Stock Market Impact, and What You Need to Know

As India approaches the Union Budget for the fiscal year 2025-26, scheduled for February 1, 2025, several key expectations have emerged across various sectors.

Earning 0$ to 10000$ in Few days

1.Budget Highlights

What are the key highlights of Union Budget 2025?

Union Budget 2025 includes major policy reforms, targeted tax reductions, and increased infrastructure spending. The finance minister is expected to announce measures for boosting rural development, healthcare, and education. Emphasis on digital transformation and green energy initiatives may also feature. Tax exemptions for middle-income earners, along with measures to stimulate job creation, are likely. Additionally, the fiscal deficit target could be reduced, reflecting the government’s commitment to fiscal responsibility and economic growth while maintaining investment in key sectors.

2. Sector-Specific Impacts

How does Budget 2025 impact the agriculture sector?

Union Budget 2025 is expected to provide significant support for the agriculture sector through increased MSP (Minimum Support Price) for key crops, subsidies for farmers, and greater funding for irrigation projects. The government may also introduce schemes for sustainable farming practices and modernizing agricultural infrastructure. Additionally, policies aimed at increasing farm exports and introducing financial tools like insurance and loans for small farmers could boost the sector. Overall, the budget aims to enhance agricultural productivity and ensure long-term growth while addressing farmers’ challenges.

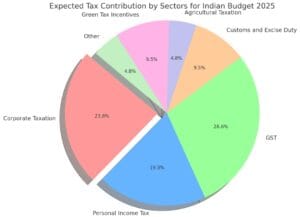

3. Taxation Changes

Has the income tax slab changed in Union Budget 2025?

In Union Budget 2025, there may be significant changes to income tax slabs to provide relief to the middle class. The government could introduce higher exemptions, increase the tax-free limit for income earners between ₹1 to ₹2 million, and reduce the tax burden on the salaried class. These changes are expected to stimulate consumption and contribute to economic growth. Along with income tax adjustments, changes to capital gains tax and corporate taxes may also occur, making the tax system more progressive and aligned with post-pandemic economic recovery efforts.

4. Stock Market Reactions

How did the stock market react to Union Budget 2025?

The stock market often reacts swiftly to Union Budget announcements, with Nifty and Sensex typically showing

volatility based on perceived market-friendly measures. In Budget 2025, sectors such as infrastructure, banking, and healthcare are expected to see a positive response, driven by government investment. However, industries facing higher taxes may experience declines. A positive sentiment would arise if the budget introduces tax cuts, fiscal stimulus, or initiatives to boost economic recovery. Global factors, such as foreign investment policies, will also influence market reactions following the budget announcements.

5. Economic Survey Insights

What are the key takeaways from India’s Economic Survey 2025?

The Economic Survey 2025 provides crucial insights into India’s economic performance and outlines challenges and opportunities. It highlights potential growth rates, inflation trends, and fiscal performance while offering recommendations for fiscal policy. A focus on improving employment, bolstering infrastructure, and increasing private investment is expected. The Survey may also address global economic uncertainties, domestic consumption, and structural reforms. Key areas for policy focus could include sustainability, job creation, and maintaining fiscal discipline while promoting inclusive growth. The budget will likely align with these recommendations to ensure balanced economic development.

6. Expert Opinions & Analysis

What do financial experts say about Union Budget 2025?

Financial experts are likely to analyze Union Budget 2025 based on its focus on economic growth, fiscal responsibility, and social welfare. They will look for measures that stimulate demand, investment, and employment, particularly post-pandemic recovery strategies. Experts will closely examine tax reforms, fiscal deficit targets, and plans for infrastructure development. Reactions may vary, but overall, there is anticipation that the government will focus on sustaining growth while managing inflation and the fiscal deficit. Their insights could provide clarity on the impact of the budget on sectors like banking, energy, and IT.

7. Historical Comparisons

How does Union Budget 2025 compare to Budget 2024?

Union Budget 2025 will likely see adjustments to tax policies, fiscal targets, and economic priorities when compared to Budget 2024. While Budget 2024 emphasized pandemic recovery and fiscal stimulus, Budget 2025 is expected to focus on sustainable growth, fiscal consolidation, and long-term infrastructure investments. Changes in income tax slabs and potential exemptions may feature more prominently in Budget 2025. The comparison will also highlight shifts in sectoral allocations, with more focus on green energy, digital transformation, and rural development. The government’s approach to public sector enterprises may also evolve in 2025.

8. Public Reactions & Opinions

What is the public reaction to Union Budget 2025?

Public reaction to Union Budget 2025 will largely depend on how effectively it addresses the common citizen’s needs. If the budget includes tax relief for the middle class, job creation initiatives, and support for healthcare and education, it could receive positive responses. However, any increase in taxes or reduced subsidies might lead to dissatisfaction, especially among lower-income groups. Public reactions will also be shaped by social media, where immediate opinions on issues like price hikes, new taxes, and government schemes will trend. Citizens will likely focus on the practical impact of the budget on their daily lives.

Union Budget 2025 & Its Impact on the Indian Stock Market – A Descriptive Analysis

As the Union Budget 2025 approaches, the Indian stock market has witnessed significant movement, reflecting investor anticipation and market expectations. The BSE Sensex and Nifty 50 have shown strong rallies in the days leading up to the budget, driven by hopes of favorable economic policies, tax reliefs, and infrastructure spending. However, concerns about global market corrections, fiscal discipline, and potential sectoral shifts remain key risk factors.

1. Pre-Budget Rally & Market Sentiment

Recent Market Movements (January 2025)

- The Sensex surged by 2,134 points over the last four sessions before the budget announcement, crossing the 77,500 mark.

- The Nifty 50 gained 679 points, reaching 23,508.40, showcasing strong investor confidence.

- Investors are optimistic about potential tax benefits, increased government spending, and reforms in key industries like manufacturing, IT, and infrastructure.

Why is the Market Rallying?

- Expectations of Tax Cuts: Possible income tax slab revisions may increase disposable income, boosting consumption and corporate earnings.

- Infrastructure & Capex Boost: The government may continue its focus on capital expenditure, benefiting infrastructure and construction stocks.

- Support for MSMEs & Startups: Favorable policies for the manufacturing and startup ecosystem could encourage new investments.

- Foreign Direct Investment (FDI) Policies: Investors expect relaxed norms and incentives for foreign investors, which could strengthen market inflows.

2. Sector-Wise Impact of Budget 2025 on Stock Market

Different sectors are expected to react differently based on budgetary allocations and policy changes:

🔹 Positive Impact Expected on:

✅ Banking & Financial Services: If the government announces incentives for digital banking, public sector banks (PSBs) recapitalization, or credit expansion.

✅ Infrastructure & Real Estate: A rise in capital expenditure, urban development initiatives, and housing subsidies can benefit construction and cement stocks.

✅ Renewable Energy & Electric Vehicles (EVs): Any subsidy on green energy projects or tax exemptions for EV manufacturers will boost stocks in this segment.

✅ IT & Tech Industry: Increased incentives for AI, data centers, and IT exports may benefit major tech companies.

✅ Pharmaceuticals & Healthcare: Higher healthcare spending and incentives for pharma R&D could drive growth in healthcare-related stocks.

🔻 Sectors at Risk:

⚠️ Oil & Gas: If the government introduces additional excise duties or removes existing subsidies, the sector could face short-term headwinds.

⚠️ Luxury & Sin Stocks (Alcohol, Tobacco, Gambling): Higher taxation on luxury goods and sin industries may lead to stock corrections.

⚠️ Import-Heavy Industries: Any increase in customs duties to promote domestic manufacturing could impact import-dependent industries like automobiles and electronics.

3. Economic Survey 2025 – Key Risks & Challenges

Before the budget, the Economic Survey 2025 highlighted some crucial risk factors:

- Stock Market Overvaluation: The survey warns that U.S. market corrections could have a cascading effect on India, particularly as retail investor participation increases.

- Fiscal Deficit Concerns: If the government increases spending without controlling the fiscal deficit, it may lead to inflation and volatility in bond yields.

- Global Economic Headwinds: Rising global interest rates, geopolitical tensions, and supply chain disruptions could impact investor sentiment.

4. Market Reaction Post-Budget – What to Expect?

🔹 Scenario 1: Market Bullish (Nifty & Sensex Rise)

If the budget focuses on tax cuts, infrastructure development, incentives for key sectors, and strong fiscal discipline, markets could extend their rally.

🔹 Scenario 2: Market Volatile (Short-Term Selloff)

If there is an increase in taxation, fiscal deficit concerns, or lack of big announcements for growth sectors, markets may experience short-term corrections.

🔹 Scenario 3: Sector-Specific Movements

While the overall market may be neutral, sector-specific gains and losses will occur based on direct policy implications.

5. Investment Strategy for Union Budget 2025

✅ Long-Term Investors: Focus on fundamentally strong sectors like infrastructure, banking, healthcare, and technology.

✅ Short-Term Traders: Expect volatility; trade cautiously based on budget announcements.

✅ Defensive Investors: Consider stocks in FMCG, healthcare, and large-cap blue-chip companies for stability.

Income Tax Slabs for FY 2024-25 – India

| Income Slab (₹) | Tax Rate |

|---|---|

| Up to ₹3,00,000 | 0% (Tax-Free) |

| ₹3,00,001 – ₹6,00,000 | 5% |

| ₹6,00,001 – ₹9,00,000 | 10% |

| ₹9,00,001 – ₹12,00,000 | 15% |

| ₹12,00,001 – ₹15,00,000 | 20% |

| Above ₹15,00,000 | 30% |

keep the notifications ON

Earning 0$ to 10000$ in Few days

Follow Moneyteaches

3 thoughts on “India Union Budget 2025 vs 2024: Key Differences, Stock Market Impact, and What You Need to Know”