Table of Contents

Are you looking for the best high-yield savings account in 2025? With interest rates fluctuating, finding a high-yield savings account that offers the best return on your money is crucial.

A high-yield savings account is a type of savings account that offers significantly higher interest rates than traditional savings accounts. These accounts help your money grow faster while maintaining easy access to funds.

Subscribe to our newsletter!

Why Choose a High-Yield Savings Account?

- Higher Interest Rates: Earn more on your deposits.

- Low Risk: Unlike stocks, savings accounts are FDIC or NCUA insured.

- Liquidity: Withdraw funds anytime without penalties.

- No Market Volatility: Your balance remains stable while earning interest.

How to Open a High-Yield Savings Account in 2025?

Opening a high-interest savings account is simple and can be done online in a few minutes. Follow these steps:

1. Choose the Right Bank

Compare banks offering the best high-yield savings accounts and select one that suits your needs.

2. Gather Your Documents

You’ll need:

- Government-issued ID (Driver’s license, Passport, etc.)

- Social Security Number (SSN)

- Proof of Address (Utility bill, Lease agreement)

- Employment/Income Details (Some banks may ask)

3. Apply Online

Visit the bank’s official website, fill out the online application, and provide the required information.

4. Fund Your Account

Deposit money via:

- Bank transfer

- Mobile check deposit

- Wire transfer

- Cash deposit (at select banks)

5. Start Earning Interest

Once your account is funded, you’ll start earning interest right away!

Budget Smarter in 2025 – Top 10 Apps to Manage Your Finances

How High-Yield Savings Accounts Grow Your Money

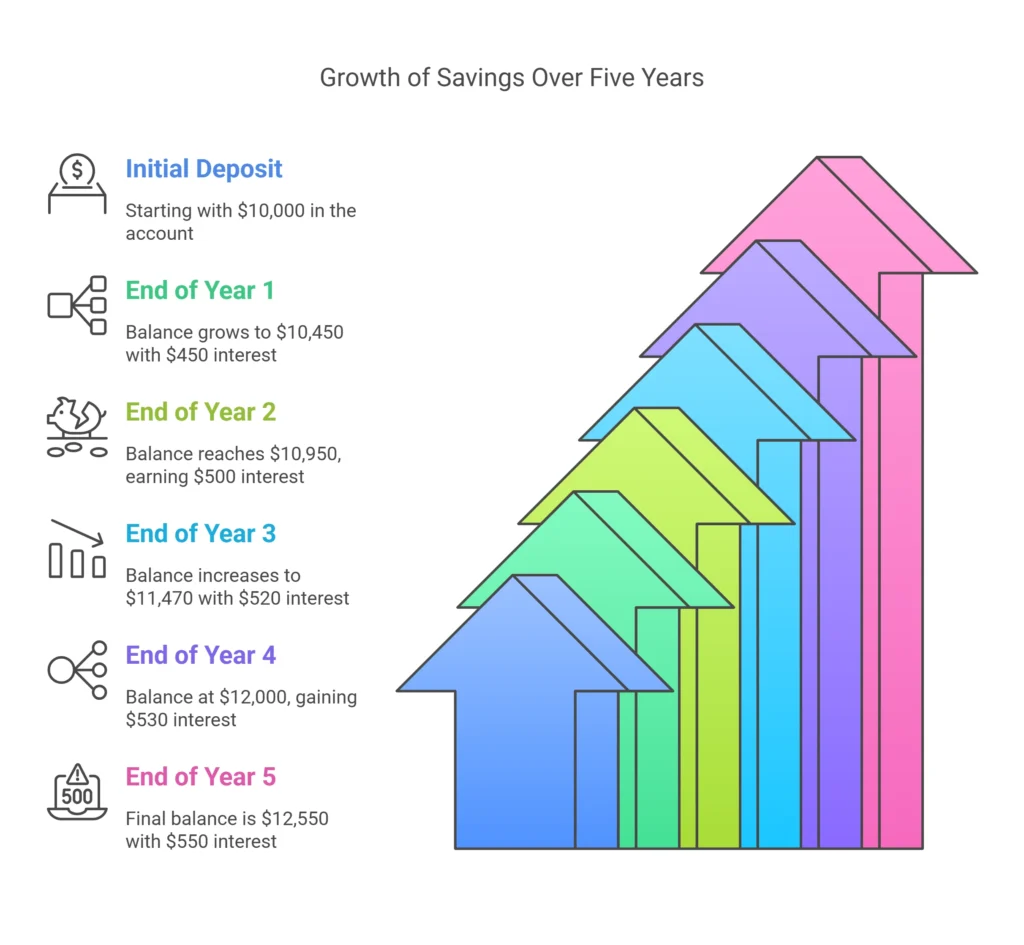

Imagine you deposit $10,000 in a savings account with a 4.50% APY:

| Year | Balance at Year-End | Interest Earned |

|---|---|---|

| Year 1 | $10,450 | $450 |

| Year 2 | $10,950 | $500 |

| Year 3 | $11,470 | $520 |

| Year 4 | $12,000 | $530 |

| Year 5 | $12,550 | $550 |

Best Uses for a High-Yield Savings Account

A high-yield savings account is perfect for short-term and emergency savings. Here’s how you can use it:

🔹 Emergency Fund

Experts recommend saving 3-6 months’ worth of expenses in a high-yield savings account for unexpected situations like medical emergencies, job loss, or car repairs.

🔹 Short-Term Goals

If you’re saving for a vacation, a new car, or a wedding, keeping your money in a high-interest savings account ensures it grows while remaining accessible.

🔹 Down Payment for a Home

Planning to buy a house? A high-yield savings account is a great place to store your down payment while earning extra interest.

🔹 Tax or Insurance Payments

Set aside money for property taxes, home insurance, or other large annual expenses in an interest-bearing savings account.

Top 10 Best High-Yield Savings Accounts in 2025

| Bank/Institution | APY (Annual Percentage Yield) | Minimum Balance | Monthly Fees | Best For |

|---|---|---|---|---|

| Ally Bank | 4.50% | $0 | None | Online Banking |

| Marcus by Goldman Sachs | 4.40% | $0 | None | High Yield |

| Discover Bank | 4.35% | $0 | None | No Fees |

| American Express | 4.30% | $0 | None | Reliable Brand |

| SoFi | 4.20% | $0 | None | High Yield + Bonuses |

| Citi Accelerate | 4.15% | $1 | None | Existing Citi Users |

| Synchrony Bank | 4.10% | $0 | None | ATM Access |

| Capital One | 4.05% | $0 | None | User-Friendly |

| Varo Bank | 4.00% | $0 | None | Mobile Banking |

| Chime | 3.85% | $0 | None | No Hidden Fees |

Note: Rates may vary based on market conditions.

Budget Smarter in 2025 – Top 10 Apps to Manage Your Finances

How to Choose the Best High-Yield Savings Account?

1. Compare Interest Rates

Look for savings accounts with the highest interest rates to maximize earnings.

2. Check Fees & Requirements

Avoid accounts with monthly maintenance fees or balance requirements.

3. Access & Convenience

Choose a bank with easy online access, mobile banking, and ATM withdrawals.

4. FDIC/NCUA Insurance

Ensure your high-interest savings account is insured for up to $250,000.

Maximizing Your High-Yield Savings Account Earnings

To get the most out of your high-yield savings account, follow these strategies:

Deposit Large Amounts

The more money you deposit, the more interest you earn.

Avoid Withdrawal Limits

Many banks limit free withdrawals to 6 per month. Stay within this limit to avoid penalties.

Look for Bonus Offers

Some banks offer sign-up bonuses (e.g., deposit $10,000 and get $200).

Monitor Rate Changes

Interest rates change frequently. If your bank lowers its rate, consider switching to a higher-paying account.

Advanced Strategies to Maximize High-Yield Savings Accounts

While high-yield savings accounts already offer great returns, you can optimize your earnings further with these pro strategies:

1. Leverage Multiple Accounts for Rate Optimization

🔹 Banks frequently adjust their APYs. Instead of keeping all your money in one account, consider diversifying across multiple high-yield savings accounts to always benefit from the best rates.

Example: If Ally Bank offers 4.50% APY today but drops to 4.00% in a few months, you can move your funds to Marcus by Goldman Sachs (if they still offer 4.40%+).

2. Laddering with CDs & Savings Accounts

CDs (Certificates of Deposit) often have higher APYs than high-yield savings accounts, but they lock your money. A laddering strategy helps you balance liquidity and higher returns:

🔹 Strategy Example:

- Keep 50% of your savings in a high-yield savings account (liquid funds).

- Place 25% in a 6-month CD (higher APY, short-term commitment).

- Put 25% in a 1-year CD (maximizing long-term gains).

This ensures you always have access to cash while benefiting from higher interest rates.

3. Automate Your Savings

Many banks offer an “Auto-Save” feature, letting you automatically transfer money from checking to savings accounts at regular intervals.

Why It Works:

- Ensures consistent growth.

- Avoids the temptation to spend.

- Helps take advantage of compound interest faster.

4. Utilize High-Yield Checking Accounts for Extra Interest

Some banks offer high-yield checking accounts that also pay competitive interest rates. You can split your funds for maximum flexibility.

Example:

- High-Yield Savings (4.50% APY) → Store bulk savings.

- High-Yield Checking (3.00% APY) → Cover everyday expenses.

🔹 Best Banks Offering Both Accounts:

- SoFi Bank: 4.20% APY savings + 1.20% APY checking.

- Axos Bank: 3.30% APY savings + 2.00% APY checking.

Future Trends: Where Are High-Yield Savings Accounts Headed?

🔹 1. Digital-Only Banks Leading the Market

Fintech banks like Chime, SoFi, and Varo are offering higher APYs due to lower operating costs (no physical branches). Expect more online-only savings accounts in 2025.

🔹 2. AI-Powered Interest Rate Optimization

Some banks now offer AI-driven savings tools that move your money to the highest-yield accounts automatically.

Example: The app MaxMyInterest can shift your funds between banks in real-time for the best APY available.

🔹 3. Crypto & Blockchain-Based Savings

Some fintech platforms are experimenting with crypto savings accounts, offering up to 8-10% APY. However, these carry higher risks than traditional savings accounts.

Popular Crypto Savings Accounts (2025):

- Coinbase (Earn up to 5% APY)

- Gemini Earn (4.75% APY on stablecoins)

- Nexo (6%+ APY on digital assets)

Warning: Crypto savings aren’t FDIC-insured, so use them cautiously.

Alternatives to High-Yield Savings Accounts

While high-yield savings accounts are great, other options may offer higher returns:

| Option | Pros | Cons |

|---|---|---|

| Certificates of Deposit (CDs) | Higher interest rates, Fixed returns | Funds locked for a fixed term |

| Money Market Accounts | Check-writing ability, Higher APY than traditional savings | May have minimum balance requirements |

| Treasury Bonds | Safe, Government-backed, Higher yields | Interest may be lower than stocks |

| Stock Market Investments | Higher long-term returns | Risk of loss, Market fluctuations |

| Robo-Advisors | Automated investing, Good for long-term growth | No guaranteed returns, Fees apply |

Start Saving Smarter in 2025!

A high-yield savings account is one of the safest ways to grow your money. By choosing the best high-interest savings account, you can earn higher returns while keeping your money secure and accessible.

Take Action Now! Open a high-yield savings account today and start earning more on your savings.

💬 Have questions? Drop a comment below!

What is a high-yield savings account?

A high-yield savings account is a type of savings account that offers higher interest rates than traditional savings accounts, helping you grow your money faster while keeping it secure.

How does a high-yield savings account work?

These accounts earn compound interest, meaning your interest earns interest over time. The higher the APY (Annual Percentage Yield), the more your money grows.

Are high-yield savings accounts safe?

Yes! Most high-yield savings accounts are FDIC-insured (up to $250,000 per depositor per bank), meaning your money is protected even if the bank fails.

Can I withdraw money anytime from a high-yield savings account?

Yes, but most banks limit withdrawals to six per month due to federal regulations. Exceeding this limit may result in penalties or account restrictions.

Do high-yield savings accounts have fees?

Many online banks offer fee-free high-yield savings accounts, but some traditional banks may charge maintenance fees. Always check the terms before opening an account.

How do I choose the best high-yield savings account?

Look for accounts with:

1. High APY (4%+ preferred)

2. No monthly fees

3. Easy online access

4. Strong security & FDIC insurance

Can I have multiple high-yield savings accounts?

Yes! You can open multiple accounts to maximize interest earnings and take advantage of different banks’ promotional rates.

How often do interest rates change?

APYs on high-yield savings accounts fluctuate based on the Federal Reserve’s rate changes. If rates drop, consider switching banks for a better yield.

What’s the difference between a high-yield savings account and a money market account?

While both offer higher interest rates than regular savings, money market accounts may allow check-writing and debit card access, whereas high-yield savings accounts are mainly for saving.

Is a high-yield savings account better than a CD (Certificate of Deposit)?

CDs often have higher fixed interest rates but require you to lock in your money for a set period. High-yield savings accounts offer more flexibility with slightly lower rates.

Subscribe to our newsletter!

Reach Out At:

- What Is a Credit Score? – Complete Guide for Understanding and Improving It

- The Ultimate Guide to Personal Finance

- Why is the Stock Market Down Today? Understanding the Sensex and Nifty 50 Crash

- Best Stocks to Buy Now for Long-Term Investment in India (2025)

- Unified Pension Scheme: A Complete Guide for India

One thought on “Best High-Interest Savings Accounts 2025: Find the Highest Yield for Your Money”

Comments are closed.