Introduction to Credit Scores

Have you ever wondered, “What is a credit score?” You’re not alone. Credit scores can seem confusing at first, but they’re one of the most important numbers in your financial life. From buying a car to renting an apartment, your credit score can open doors—or close them.

This guide breaks it all down into simple terms so you can take control of your financial future.

Defining What Is a Credit Score?

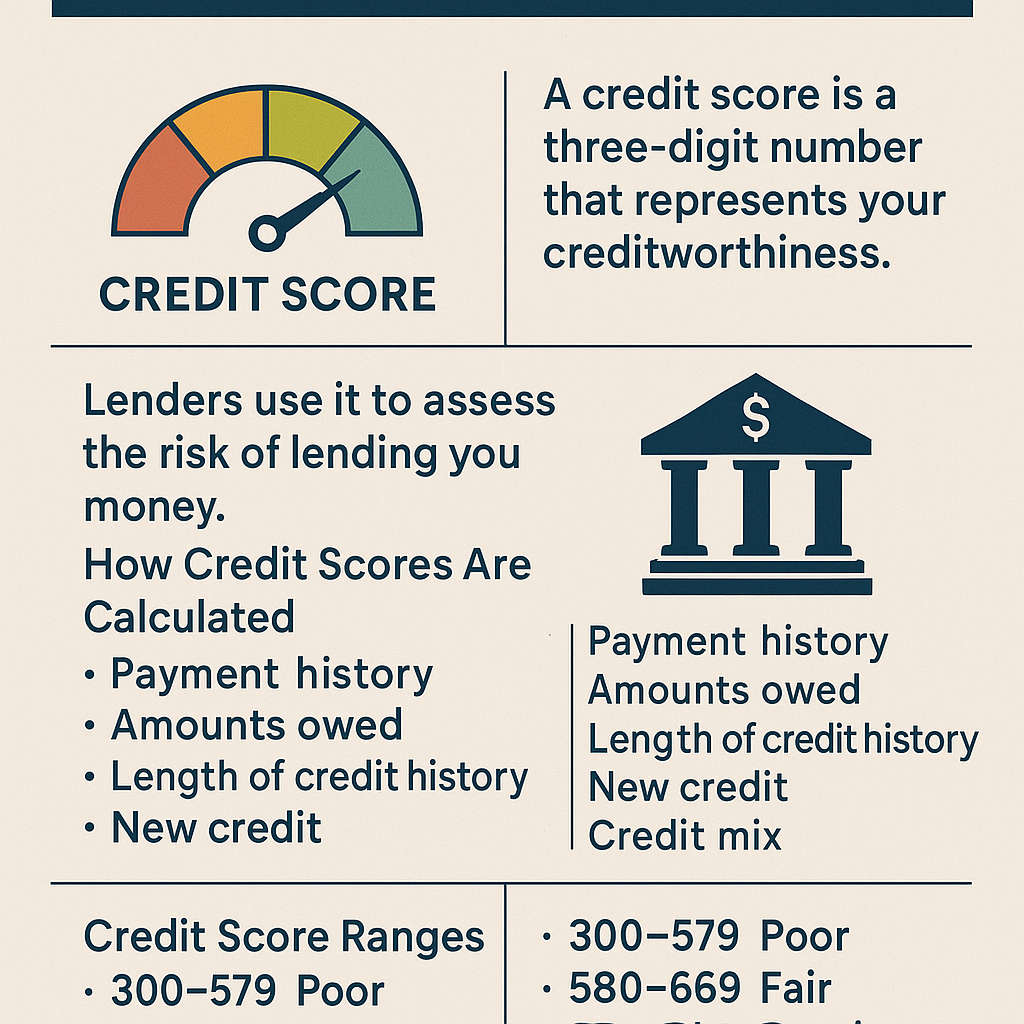

A credit score is a three-digit number that tells lenders how likely you are to repay borrowed money. Think of it like a report card for your financial responsibility. The score is calculated using information from your credit report, which records your history of borrowing and repaying loans.

Who uses it?

- Banks and lenders (for loans and credit cards)

- Landlords (to approve rental applications)

- Insurance companies

- Even some employers

How Are Credit Scores Calculated?

Credit scores are calculated based on several weighted factors:

| Factor | Impact on Score |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Length of Credit History | 15% |

| New Credit/Inquiries | 10% |

| Credit Mix | 10% |

- Payment history: Pay on time, every time.

- Credit utilization: Keep your balances low (under 30% is ideal).

- Length of history: Older accounts help your score.

- New credit: Too many recent applications can hurt.

- Credit mix: A variety of accounts (cards, loans) is a plus.

The Different Credit Scoring Models

Two major models dominate the credit scoring world:

- FICO Score – Used by 90% of top lenders.

- VantageScore – Used for free score tracking and newer evaluations.

Both use similar scoring ranges but might weigh data differently. That’s why your credit score can vary depending on where you check it.

Credit Score Ranges Explained

| Score Range | Category | Impact |

|---|---|---|

| 800–850 | Excellent | Best rates and approvals |

| 740–799 | Very Good | Low interest, easy approvals |

| 670–739 | Good | Accepted by most lenders |

| 580–669 | Fair | Higher interest, limited options |

| 300–579 | Poor | May be denied or require secured loans |

Knowing your score range helps you understand what kind of financial opportunities are available to you.

Credit Reports vs. Credit Scores

Credit Report: A detailed summary of your credit activity, accounts, and history.

Credit Score: A number generated from the information in your credit report.

You can get a free report annually from AnnualCreditReport.com. Check it for errors and outdated info regularly.

How to Check Your Credit Score

You can check your score for free using:

- Credit Karma

- Credit Sesame

- Your credit card issuer

- Mint

- Experian, Equifax, TransUnion websites

There are two types of credit checks:

- Soft Inquiry: Doesn’t affect your score (used by you or for pre-approvals).

- Hard Inquiry: Can reduce your score temporarily (used by lenders).

Who Can See Your Credit Score and Report?

Access to your credit info is regulated, but here’s who might see it:

- Banks and credit card issuers

- Mortgage lenders

- Landlords

- Insurance companies

- Employers (in some states)

They must get your permission first, especially employers.

Why Credit Scores Are Important

A good credit score can help you:

- Get better interest rates on loans

- Qualify for higher credit limits

- Pay less for insurance

- Rent in competitive housing markets

- Avoid needing a co-signer

How to Improve Your Credit Score

Improving your score takes time, but it’s worth it:

- Always pay on time

- Pay down credit card balances

- Limit new credit applications

- Don’t close old accounts

- Use a mix of credit types responsibly

Credit-Building Tools and Techniques

- Secured credit cards: A great way to start building credit with a deposit.

- Credit builder loans: Helps create a history of on-time payments.

- Authorized user status: Piggybacking on a family member’s credit card.

- Apps: Like Experian Boost or Self.

Common Myths About Credit Scores

Myth: Checking your credit hurts it.

Truth: Only hard inquiries affect your score.

Myth: Closing a credit card improves your score.

Truth: This may hurt your credit utilization ratio and credit history length.

Myth: You only have one credit score.

Truth: You have multiple scores from different models and bureaus.

Legal Rights Related to Credit Scores

Under the Fair Credit Reporting Act (FCRA):

- You can request one free credit report per bureau per year.

- You have the right to dispute errors.

- You must be notified if information from your report was used against you.

Credit Score Tips for Beginners

- Start with a secured card.

- Pay small bills on time.

- Keep balances low.

- Use tools like Credit Karma to track your score.

- Learn from your report, not just the number.

FAQs About What Is a Credit Score?

What is a good credit score to aim for?

A score above 700 is generally considered good.

Can I get a credit card with no credit history?

Yes, secured cards are a great starting option.

How fast can I improve my credit score?

Significant improvements may take 3–6 months or more.

Will paying off all debt raise my score?

Yes, but keep at least one account active with minimal use.

What’s the difference between FICO and VantageScore?

Both are scoring models but use different formulas.

Can I remove late payments from my report?

Only if they’re reported in error or through goodwill adjustments.

Conclusion: Take Control of Your Credit Future

So, what is a credit score? It’s your financial fingerprint—a number that can impact nearly every area of your financial life. By understanding how it works and taking small, smart steps, you can raise your score, gain better opportunities, and enjoy more financial freedom.